Declining Steadily

Declining Steadily

The great inflation scare of the post-pandemic era has been driven by a series of adverse shocks over the past four years. After collapsing at the beginning of the pandemic in early 2020, global inflation started to pick up later in the year as demand bounced back, supply bottlenecks tightened, and oil prices rebounded. Inflation rose further following the Russian invasion of Ukraine as oil and food prices jumped and renewed supply disruptions emerged.

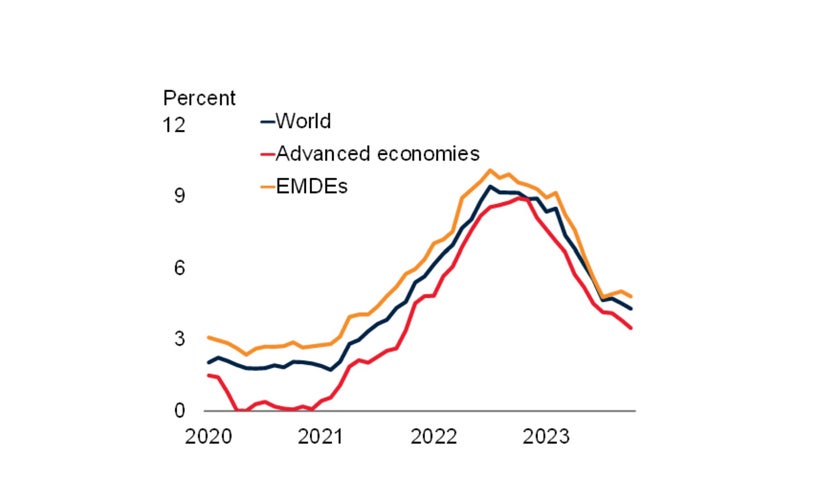

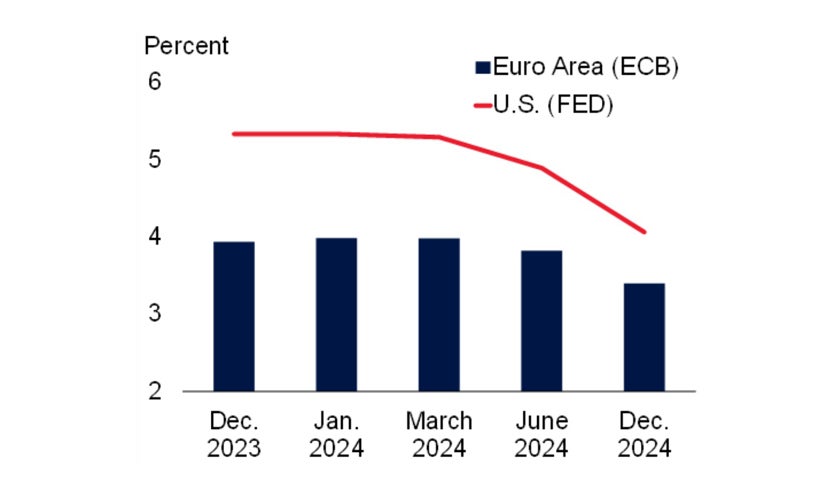

Since July 2022, however, global inflation has been declining steadily (Figure 1). Professional forecasts, financial market-based inflation expectations, consumer surveys, and model-based estimates all point in the same direction: in the coming months, global inflation has nowhere to go but down (Figure 2). Embracing this consensus, financial markets now expect major central banks to cut interest rates in the first half of next year (Figure 3). So, is the great inflation scare over?

Messages from the major central banks last week suggest divergent answers. The United States Federal Reserve signaled a possible shift in its policy stance, aligning its interest-rate trajectory closer to market expectations. But the European Central Bank and the Bank of England stuck to their earlier positions, noting that a pivot in their policy stance would be possible only if credible evidence of a sustained decline in inflation emerges.

There are reasons for optimism. Many factors should push global inflation down further in the coming months. But caution will remain in order until that happens. A few risks persist that could delay the decline in inflation or reignite price pressures.

Figure 1. Global headline CPI inflation

Figure 2. Survey-based inflation expectations

Figure 3. Market-based interest rate expectations

Figure 4. Contributions of global shocks to global inflation variation

Sources: Consensus Economics; Ha, Kose, Ohnsorge, and Yilmazkuday (2023); Haver Analytics; World Bank.

Reasons for optimism

All fundamental drivers of inflation suggest that global inflation should decline in the coming months : global demand is easing, supply disruptions are fading, and commodity prices are moderating while monetary policies remain restrictive. Inflation is highly synchronized across countries, implying that these factors will likely drive down inflation around the world.

- Global demand is expected to moderate next year amid tight financial conditions, weak global trade, and limited fiscal support. Global demand-related factors account for nearly 30 percent of the variation in inflation (Figure 4). As global activity slows, the impact of these demand-related factors on inflation will become smaller.

- Easing global supply pressures are also expected to contribute to the fall in worldwide inflation. These pressures have recently receded to historic lows because of the broad-based weakness in goods trade and the fading of pandemic-era supply disruptions. Despite still-tight labor markets, job openings have gradually declined, and wage growth has been generally moderating in the United States and some other advanced economies.

- After dropping 17 percent this year, oil prices are expected to continue to fall in 2024 as subdued global growth reduces demand pressures . Oil prices play a critical role in driving global headline inflation, as post-pandemic developments have clearly shown. Indeed, oil price movements account for about 40 percent of the fluctuations in inflation.

- Monetary policy will remain restrictive in major economies to ensure inflation returns to central bank targets. Despite the recent decline in inflation, all three major central banks have reiterated their intention to maintain high policy interest rates until they see convincing evidence of disappearing price pressures, although the United States Federal Reserve did signal the possibility of rate cuts in 2024. The implication is that even if central banks start cutting policy rates, they will keep them high enough to push down price pressures. The lagged and ongoing effects of elevated real interest rates are set to keep global activity weak, thereby further moderating inflationary forces in the coming months.

Reasons for caution

Yet there are at least two key reasons to be cautious about the future pace of disinflation: the potential for an inflationary shock stemming from geopolitical tensions as well as continuing pressures that have kept core inflation high. Central banks still need to worry about whether they can lower inflation to their target ranges without triggering a sharp downturn in activity.

- The decline in global core inflation has been smaller than that of headline inflation over the past 14 months (Figure 5). Sustained price pressures in services driven by strong demand limited the decrease in core inflation. Going forward, core price inflation must continue to decline to convince central banks that inflationary pressures have been brought firmly under control. This will likely require further moderation in demand, particularly for services, along with weakening labor markets.

- Geopolitical tensions have been a serious inflationary force for decades. The latest conflict in the Middle East—on the heels of disruptions caused by the Russian invasion of Ukraine—could be another major driver of inflation by destabilizing global energy markets. Although the impact has been limited so far, an escalation of the conflict could sharply increase oil prices as the region accounts for nearly 30 percent of global oil production. When oil prices go up by 10 percent, global inflation increases by 0.35 percentage points within a year. Such an increase in oil prices could also affect core inflation, if there are large second-round effects on wages and broader production costs and inflation expectations shift higher.

Figure 5. Global core CPI inflation

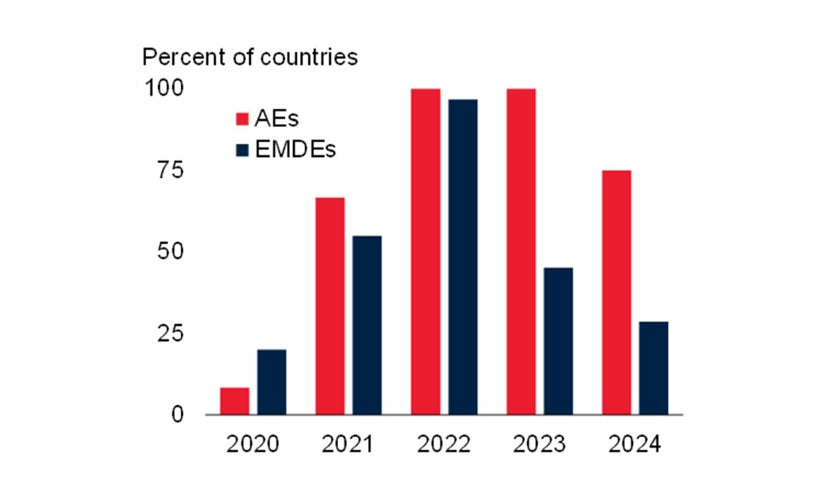

Figure 6. Share of countries with inflation above target

Although inflation has been coming down worldwide over the past year, it remains above target in two-thirds of the inflation-targeting countries (Figure 6). Professional forecasters predict that inflation will remain above target in more than two-fifths of these countries next year. Inflation has declined in many developing economies over the past two years, but it remains at double-digit levels in more than one-fifth of these economies.

Central banks are unlikely to sharply cut interest rates until they are convinced inflation is firmly on a path back to the target ranges . This means monetary policy will continue to be restrictive. Possible disruptions in global energy markets and supply chains could prolong the quandary currently faced by many central banks: how to lower inflation to target ranges while engineering a soft landing.

The recent decline in inflation is a welcome sign, but it’s too soon to break out the champagne. There are still risks that could slow the decline in inflation—or push it higher. Because inflation tends to be globally synchronized, an inflation resurgence in advanced economies could hurt developing economies as well.

Join the Conversation