Later this year the Financing for Development summit will take place in Addis Ababa. The discussion will focus on the post-2015 agenda and the implementation of the Sustainable Development Goals (SDGs), which will need a massive amount of financing.

Where is all that money going to come from?

Dilip Ratha, lead economist and head of the Global Partnership on Migration and Development at the World Bank Group has a “$100 billion idea.”

He believes four under-exploited market-based financing options connected to migration could foster financial market infrastructure in the developing countries and channel incoming remittances into investment. His goal: to raise at least $100 billion annually.

How?

Reducing remittance costs: Current remittance costs are exorbitant; the global average is 8%. The target is to reduce it to 3% by 2030, which could bring up to $20 billion to migrants and their families. Technology is a great asset to reduce costs with online and mobile money transfer systems.

Mobilizing diasporas through diaspora bonds: International migrants tend to save part of their income in bank deposits in their destination countries. A diaspora bond issued by countries of origin could be attractive to migrant workers who currently earn low interest on deposits held in host-country banks. This could result in 50 billion dollars for financing development projects.

Reducing migrant recruitment costs would bring up to $20 billion from reducing recruitment fees paid by low-skilled migrant workers and by better monitoring recruitment agencies. At the same time, this would reduce modern-day slavery and abuse by eliminating illegal recruitment fees.

Diaspora philanthropy: Modifying remittance forms to allow small donations for specific causes — for example, adding a box at the end of the form asking for a $10 to fight malaria in the region —could result in $10 billion.

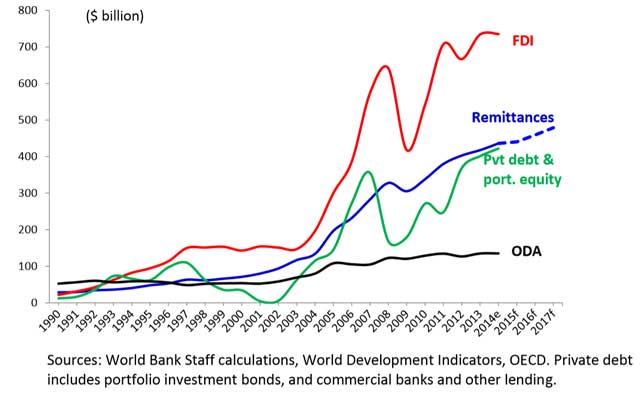

In addition to these four, Ratha added one more: Using remittances as collateral for international borrowing and enhancing sovereign credit ratings. Remittances are larger and more stable than other types of capital flows and can decrease borrowing costs, lengthen debt maturity, and enhance recipient country’s sovereign credit rating. This could result in $40 billion to $50 billion for Africa alone. Remittances can also facilitate poor people’s micro-saving and micro-insurance.

“Remittances enhance financial inclusion and leads to financial stability” said Atiur Rahman, governor of the Central Bank of Bangladesh. He said Bangladesh has made huge changes in the delivery of remittances. Governments have made some moves, but publicprivate partnerships are still needed, and the private sector needs monitoring.

Relevant documents:

The Migration and Development Brief. April 13, 2015

The latest migration and remittances data are available at www.worldbank.org/migration

Join the Conversation