Thanks to the generous support from the Global Water Security and Sanitation Partnership (GWSP) and the Private Infrastructure Development Group (PIDG), the World Bank Group’s water team has just launched an e-learning course on Water Utility Creditworthiness, open to the public. The course focuses on helping water utilities become creditworthy, meaning becoming more attractive to commercial financiers. It also aims to help the governments create an environment that promotes creditworthy water utilities.

Why creditworthiness matters

Why is the World Bank Group’s Water team focusing on creditworthiness? Why does it matter? Why does the water public and private sector of this world need to work more closely with commercial financiers?

As part of a renewed effort to scale up financing for water, the World Bank Group’s water team is doubling down on the mobilizing finance for development (MFD) agenda, to advance sustainable private sector investments and solutions. The new strategy recognizes that working on the demand side of financing is a critical imperative because the lack of creditworthy water service providers is one of major barriers for MFD in the sector. This course on water creditworthiness is designed to help them tackle this issue head on. It discusses various aspects of utility business, such as governance, financial and operational management, planning and budgeting, guiding the participants on how each of these aspects can be, and should be improved to enhance utility creditworthiness.

This course is strongly linked with global efforts by the GWSP with the World Bank and many of our partner countries and other members of the development community for the reform, institutional strengthening and the building of capacities that will drive financial flows to water and development. It is timely given the recent commitments to water as probably the most valuable resource on earth, by partners at the recently concluded UN Water Conference.

Despite the efforts made by the governments and development communities over decades, achieving the United Nations' Sustainable Development Goal (SDG) 6.1 and 6.2—on safe drinking water and sanitation—by 2030 is proving to be challenging. According to a UN report in 2020, 2.2 billion people lack access to safely managed drinking water and 3.6 billion people lack safely managed sanitation. It is a grim picture, especially considering the sector's importance in recovering from COVID-19 and preparing against the next pandemic.

Addressing the lag in achieving SDG 6.1 and 6.2 through financing

There can be many reasons behind the current situation, and one of them has to do with financing. Among many varied estimates, a 2018 World Bank report finds that the amount of funding currently being spent in the WSS sector globally, $16 billion per year, is a drop in a glass of water compared to $114 billion per year, the amount of financing needed to achieve only SDG 6.1 and 6.2.

To make it happen, we first need to deepen our understanding on commercial financing.

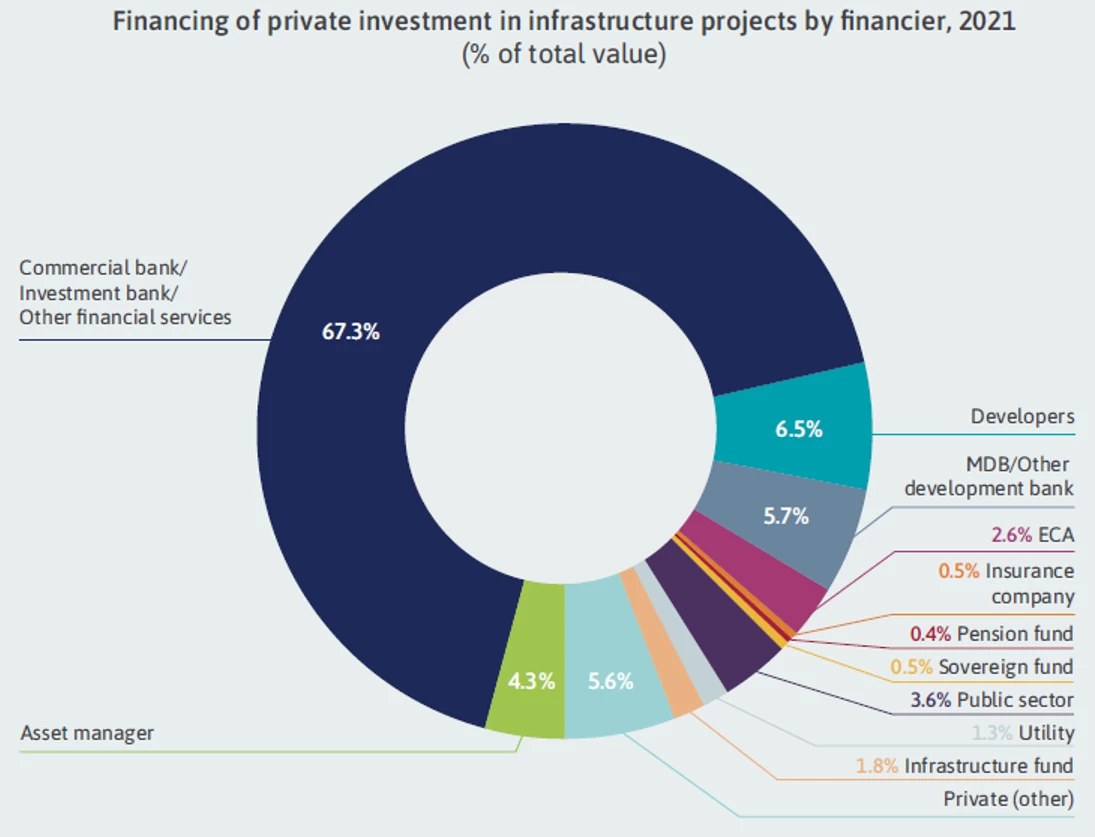

Where does the vast amount of commercial financing sit? Who are the key players? Figure 1 shows the portion of financing in infrastructure projects by financier. Among the other players, we see that commercial and investment banks are the largest private provider of financing.

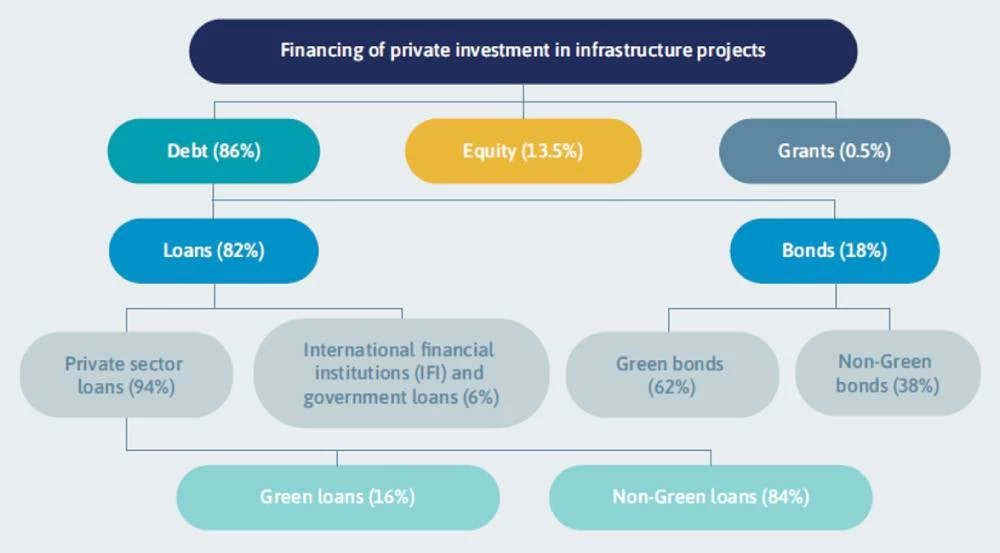

Then what kind of instruments do commercial financiers use when they invest? There are two broad instruments, and first is equity. Investing in equity means that the financier becomes the shareholder of the entity on the expectation that the stock will earn dividends or can be resold with a capital gain. The second instrument is debt, where commercial financiers lend money to the borrowers in return for interest income. There are two types of debt, bonds and loans. As shown in Figure 2, we see that debt financed 86 percent of the infrastructure projects in 2021, and between loans and bonds, loans were much larger in sum.

So, there are commercial financiers out there, and there are instruments that they use. However, we do not see enough commercial financing in the water sector. It is partly because, the water utilities’ business characteristics differ quite a bit from what commercial financiers are used to. For example, a lot of water utilities’ assets are unsuitable for collateral, there is a timing mismatch between their costs and revenues, water utilities often experience limited scope for increasing the tariffs, and there are uncertainties that come from being a public service provider, such as regulation or political risks.

Despite these inherent characteristics that are not favorable to commercial financing, it doesn't mean it is out of reach. We know some of our water utility clients have been successful in getting commercial financing. The unfavorable characteristics rather mean that it is critical to ensure water utilities are ready before approaching the commercial financiers.

We hope you will take the course and encourage your Water counterparts to take it as well!

Other resources:

Water Utility Creditworthiness Course

Water Utility Financing e-Learning

International Benchmarking Network of Water Utilities - New Ibnet

Water Loss Reduction Performance Based Contract

Citywide Inclusive Sanitation (CWIS) Initiative

Join the Conversation