Once upon a time, the CEO of a public bank which was also the Treasury’s financial agent, visited the Minister in charge of Treasury. He told the Minister that the Treasury needs to double the balance of its bank account in a couple of days to make sure that salaries of the civil servants can be paid. Otherwise, there will be a default. The CEO also pointed out that interest rates in the markets were increasing rapidly and the difference between the market rates and subsidized credits should be transferred to the Bank, in order to keep government’s lending program working. “What happens if you continue to keep interest rates low?” the Minister asked. The CEO explained that then the Bank had to cover the cost of subsidy which results in losing money. The Minister seemed astonished and couldn’t make an immediate decision. (Excerpt from “Stories on Bureaucracy and Banking that I told my Father” by Osman Tunaboylu)

Indeed, the CEO wouldn’t have had to visit the Treasury and the Minister wouldn’t be surprised if government’s daily cash flow projections would be generated at least for three months, based on realistic assumptions, integrated with debt management, well-coordinated with budget execution and monetary policy, and finally tested under different scenarios. However, if cash rationing is in place, due to weak budget controls and unpredictable revenue inflows, availability of required amount of cash in the right time and the place will not be possible. As a result, the government delays the payments and arrears accumulate.

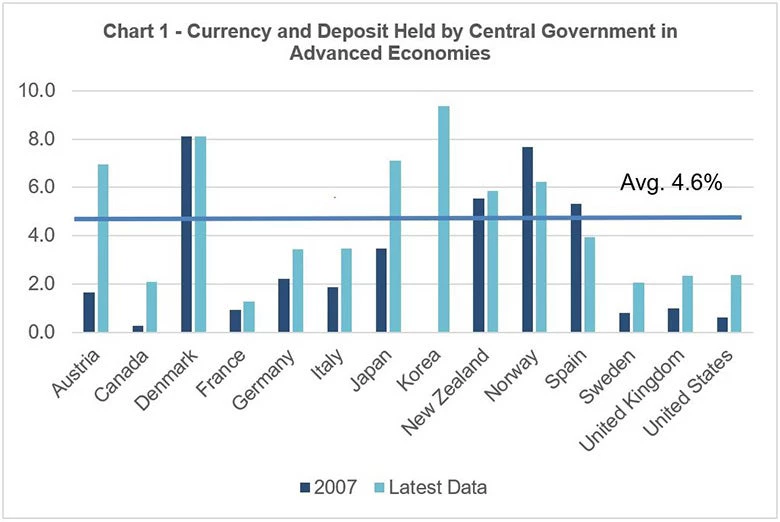

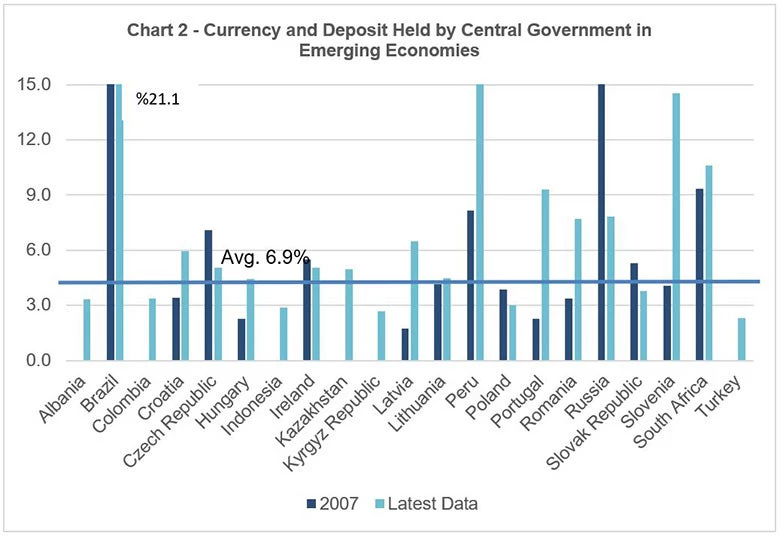

Cash management, as a process of collection, distribution and investment of cash, requires provision of reliable data, projection of cash-flows, coordination across institutions; employs treasury single account, and short-term financing instruments such as T-bill and overdraft facility; and generates return for excess liquidity. Managing cash is more important in today’s uncertain economic and political environment. Therefore, currency and deposit in both advanced and emerging countries’ balance sheet has increased significantly after the global financial crisis. In this regard, United States, as a hard currency issuer, doubled the size of liquid financial assets by increasing from 1% to 2.3%. In other advanced economies, such as Korea and Japan currency and deposit/GDP ratio reached 9.4% and 7.1% respectively.

The size of currency and deposit is even larger in emerging countries as it increases the countries’ resilience to liquidity shocks significantly. Among others, Brazil is remarkable as the amount of liquid financial assets in percentage to GDP has increased from 17% to 21% after the global crisis, with Peru and Slovenia a close second at around 15%. The average of emerging countries is 50% higher than the advanced economies.

Considering the increasing importance of cash flow forecasting and management, World Bank Treasury developed an excel-based toolkit to support the capacity building efforts of cash managers. Cash Flow Forecasting and Management (CFM) tool deployed in 2018 to be used during the hands-on exercises in the five-day Cash Flow Forecasting and Cash Management Workshop.

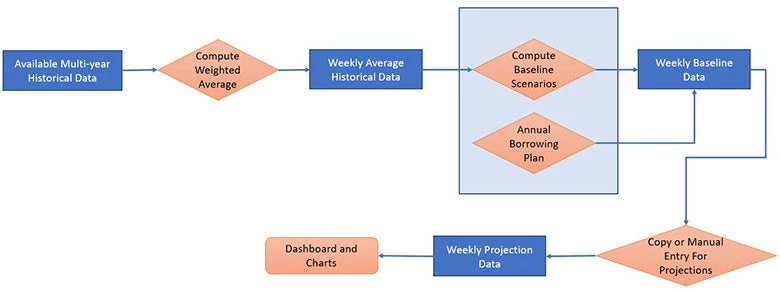

The CFM tool is designed and developed for training purposes. It utilizes historical monthly data from the past 10+ years to derive weighted averages to guide different scenarios. CFM combines historical, baseline and projected values to conduct hands-on analyses and observe comparative changes. As a training tool, CFM allows for manual input of various revenue and expenditure items, and setup of a basic annual borrowing plan to feed into the baseline values. It also allows for computation and generation of the required minimum level of cash balance to ensure meeting cash requests. A simplified dashboard visually represents changes in cash balances and borrowing.

The data flow in CFM is illustrated in the following:

CFM involves four pre-prepared scenarios for which data can be populated within the baseline and produces projections based on the scenarios created by the users. Dashboard graphs can be produced for projection values of each line item. Dynamic graph allows comparison of historical, baseline and projection. Liquidity buffer can also be modified on the dashboard sheet.

Even though the tool was deployed less than a year ago, there are countries improving their cash flow forecasting procedure by adopting the CFM tool and implementing some of the pivot tables for scenarios. Initial reactions demonstrate that CFM is very well-taken by the practitioners and filled a gap in the scarcity of resources.

From a government’s point of view, holding a high amount of cash reserve might be seen as a convenient strategy to cover the obligations for short-term operations and mitigate the liquidity risk. Governments may even tend to keep higher liquidity buffers, if daily cash flows are volatile, forecasts are uncertain and subject to forecasting errors. However, keeping cash, especially if it is borrowed, is subject to cost of carry. Therefore, strengthening the cash flow forecasting capacity could help countries to determine the right amount of cash reserves and carry with possible minimum cost – because cash is king.

Join the Conversation