وفي حين حققت الجزائر تقدما في تعزيز ابتكارات التكنولوجيا المالية وتطوير الخدمات المالية الرقمية، يمكن بذل المزيد من الجهد لزيادة الوعي بمنافعها وتحفيز نموها.

وفي حين حققت الجزائر تقدما في تعزيز ابتكارات التكنولوجيا المالية وتطوير الخدمات المالية الرقمية، يمكن بذل المزيد من الجهد لزيادة الوعي بمنافعها وتحفيز نموها.

Algeria, like the entire MENA region, has been hit by economic shocks exacerbated by the COVID-19 pandemic, including the drop in oil prices. The country’s economy is projected to post a significant real GDP contraction in 2020, according to the latest Economic Monitor. Digital transformation, one of Algeria’s main development goals before the crisis, is now a key element of the country’s recovery.

Access to affordable financial services is critical for poverty reduction, economic growth and resilience to crises and paves the way for financial inclusion — particularly for women. In Algeria today, 57% of adults and 71% of women still lack access to even the most basic transaction accounts to send and receive payments more safely and efficiently. As a result, they are denied access to broader financial services such as savings, insurance, and credit. Digital Financial Services (DFS), enabled by fintech, as well as more traditional financial services providers, have the potential to lower costs; increase speed, security, and transparency; and enable safer financial services. Better access to digital payments would be the gateway to DFS for Algerians less familiar with the financial sector.

Mobile money has leveraged high mobile phone penetration in many developing countries to deliver a 'first wave' of DFS. However, while mobile broadband connectivity in Algeria is above the MENA average, the use of DFS is still very low: only 16% of Algerian adults and 11% of women use digital payments, compared to 23% of adults and 18% of women across the MENA region, and 36% of adults and 32% of women in Emerging Markets and Developing Economies (EMDEs).

Digital payments

Digital payments allow consumers to transfer funds, pay bills, or pay for goods and services from their home, in a market, or a store. COVID-19 has amplified their benefits: they significantly reduce the need for physical contact in retail and financial transactions, keeping local businesses open during lockdowns.

How can DFS help Algeria cope with COVID-19?

DFS enable rapid, secure ways for governments to reach vulnerable people with social transfers and other financial assistance, especially when transportation and mobility are unsafe or limited. Before the current crisis, it was clear that two use-cases for DFS — beyond mobile money, remittances, and Government-to-Person (G2P) payments — were particularly beneficial for the poor.

According to the World Bank’s Remittance Prices Worldwide Database, the average global cost to send remittances in cash is 6.8%; digital transactions would drop the cost to 3.3%. Based on Findex data, millions of Algerians have an account, however, they still use means such as OTC services to send or receive domestic remittances. It is, therefore, more important than ever to reduce fees, increase funds available for remittance recipients, and encourage use of digital channels.

Digital payments can strengthen the accountability of governments that issue emergency funds to citizens and businesses by improving the tracking of funding and interventions. DFS help firms address critical liquidity issues, enabling them to interact with financial services providers, draw down on existing lines of credit without delays or disruptions and access alternative finance that can compensate for a lack of liquidity in traditional financial channels.

Other technological advancements have been critical to the development of DFS. Digital ID — launched in 2016 in Algeria — has enabled financial institutions to onboard customers efficiently in compliance with anti-money laundering and other 'know your customer' requirements. Open Application Programming Interface (API) developments have allowed DFS providers to access data from different public and private systems to improve the speed and reduce the cost of financial services without compromising safety and reliability.

DFS are also enabling entirely new business models that serve the poor. Large e-commerce platforms are gaining prominence, with the pan-African platform Jumia entering Algeria to join local platforms like OuedKniss, Batolis, and IdealForme. Telecom operators have leveraged the ability of DFS to facilitate payments and offer services such as 'pay-as-you-go solar energy, insurance and lending.

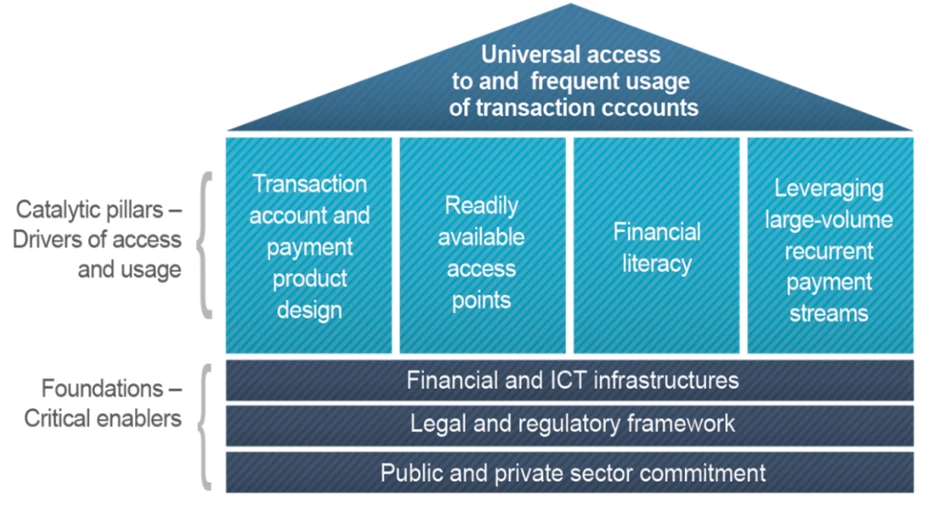

While many countries have begun to address the basic enablers for DFS and digital payments, they require robust enabling factors: conducive legal and regulatory frameworks, enabling financial and digital infrastructure, and ancillary government support systems.

Addressing these three areas requires policymakers to look at a wide range of critical issues, from basic digital connectivity and mobile-phone penetration, to providing access to national payment infrastructure and electronic money, to non-banks or rolling out digital and biometric ID systems, which enable access to government data platforms and ensure competition for access to DFS.

Critical enablers and drivers of access to/usage of digital payments (PAFI framework)

Source: CPMI-WBG Payment Aspects of Financial Inclusion Report, 2015

The benefits of financial services for the poor are well documented; however, they introduce risks to users and to the broader financial system: data privacy concerns, unequal access to technology and 'digital divide', cyber-security and operational risks, financial integrity, and challenges for the competition authorities. They all require careful regulation, monitoring and oversight by the relevant authorities.

While Algeria has made progress in boosting fintech innovations and developing digital financial services, more can be done to raise awareness to their benefits and stimulate their growth. By expanding access to DFS, Algeria will promote economic activity and facilitate the daily life of its people, allowing them to increase their assets or make productive investments, but above all, to mitigate the shocks caused by the COVID-19 pandemic.

Join the Conversation