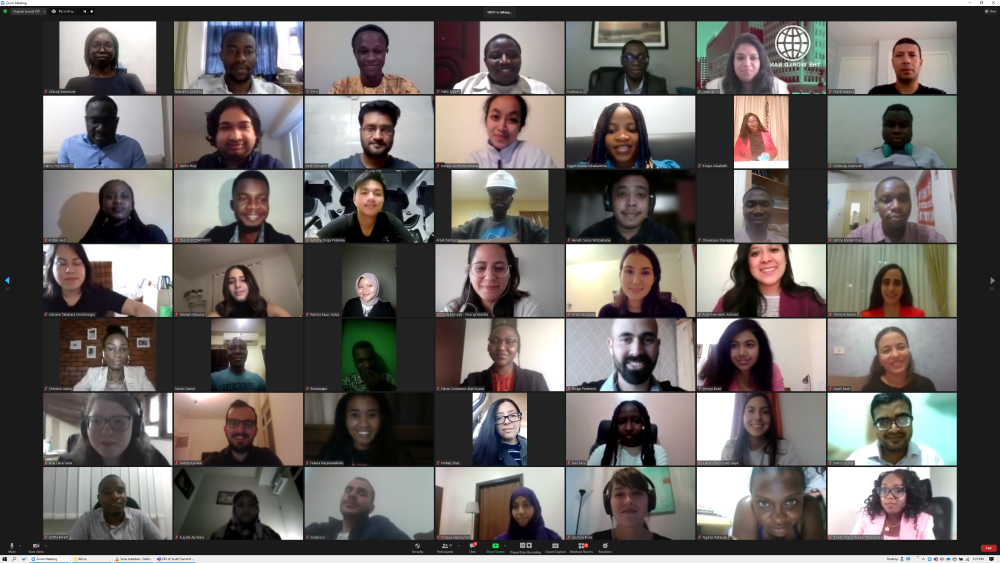

Échanges entre des jeunes lors de la partie compétition du Sommet de la jeunesse du Groupe de la Banque mondiale 2021.

Échanges entre des jeunes lors de la partie compétition du Sommet de la jeunesse du Groupe de la Banque mondiale 2021.

The COVID-19 pandemic proved that access to technological infrastructure and digital tools are essential for accessing basic services. Digital inclusion was one of the key topics discussed at the World Bank Group (WBG) Youth Summit 2021 on the theme of "Resilient Recovery for People and Planet." At the summit, we the authors (Global winners of the 2021 Case Challenge on Resilient Recovery of People and Planet), came up with suggested solutions for the MENA-region to close the digital access gap and improve the lives of marginalized and poor people.

The key challenges to digital inclusion are lack of infrastructure, lack of digital culture and lack of digital literacy in the MENA region. Other challenges in the region include unavailability of a coordinated digital market, lack of funds, and a poor education in digitalization. While the Gulf Cooperation Council countries (GCC) are at an advanced level of digital access, the Levant and Northern African countries lack uniform digital access.

After COVID-19 hit, countries in MENA rapidly responded to challenges by improving broadband network services for basic services including online learning and government services. However, these solutions are only quick interventions in the short term. We need long term solutions based on more assessments and data.

Although the overall rate of mobile broadband subscription in MENA is 62.7% in 2020 according to International Telecommunication Union (ITU), the figures are high because of the developed situation of Gulf countries . For this reason, a local needs assessment is needed.

The challenges of digital inclusion faced in MENA region are intertwined with social issues like poverty, conflict, gender inequality, forced migration and lack of access to basic services. (Data shows that the 49.7% of Arab countries are women and 15% are persons with disabilities.) MENA had nearly 9 million refugees by the end of 2020 while there were over 27 million migrants in 2020. These groups usually have vulnerabilities in accessing services and even rights in MENA. Without taking these issues into account, it might not be possible to respond to the digital divide effectively. An integrated approach could be quite effective combining humanitarian, development, and peace interventions: the Humanitarian-Development-Peace (HDP) Nexus approach applied to reach the medium-to-long term results.

With this regard, the Leave No One Behind (LNOB) approach is an overarching principle to identify the most vulnerable and the poorest. Therefore, LNOB approach aims to end extreme poverty, reduce inequalities, and address discriminatory barriers to prioritize the poor, most marginalized, and so left behind. This would help implementation to be more effective in filling digital gaps and designing a comprehensive plan to provide a more sustainable and resilient impact in the region.

The lack of digital infrastructure in MENA could be solved with a well-designed Public-Private Partnership (PPP) model which engages important stakeholders and gives government reasonable willingness and confidence to endorse subsidy mechanisms.

The World Bank Group is interested in helping; for example, it recently approved new support to Morocco to expand availability of financial services and digital inclusion, in order to increase connectivity access to rural areas, help MSMEs, and improve women’s digital inclusion and participation.

To increase the digital culture and literacy in MENA, grassroots campaigning at a local level can raise awareness regarding digital development and increase social acceptance of such digital inclusion projects.

Another way to make digital inclusion projects socially acceptable is to use mobile money to provide disadvantaged groups with an opportunity to access remote financial services. For example, mobile money in Tanzania made significant progress in improving connectivity and access to digital financial services over the past decade. Due to the high mobile phone penetration in MENA, this can help overcome infrastructure challenges; the spread of mobile financial services can unlock opportunities for new services and business models in all sectors.

Increasing digital financial services by banks and mobile companies can increase access for people to money solutions in areas where there are no bank branches, such as was proven in Tanzania’s case study. People no longer travel longer distances nor need internet facilities to access banking services, they simply dial on their phone. During the pandemic, banks lowered charges on digital transactions to reduce the number of people going into banks, leading to accelerated number of users, economic participation, and thus economic growth.

Digital IDs are also a way to include refugees across the region, since, as the UNHCR states, refugees have issues with holding a bank account due to lack of documentation or residency address. One such initiative in MENA that aims to increase access to financial services and digital employment is Techfugees Lebanon, which works to digitally include Syrian and Palestinian refugees.

A first step in increasing digital literacy in MENA can be solved by creating digital/social hubs, mobile financial services, and conducting comprehensive capacity-building programs in rural areas.

Join the Conversation