LNG feeder at terminal in Tsing Yi, Hong Kong

LNG feeder at terminal in Tsing Yi, Hong Kong

International shipping is the prime mover of trade in today’s globalized economy and is often hailed as the most energy efficient mode of transport. Yet, maritime transport relies largely on fossil-based bunker fuels, primarily heavy fuel oil (HFO) which emits large quantities of greenhouse gases (GHG) and prominent air pollutants. As a result, international shipping emits 15 percent of global sulfur oxide (SOx) and 13 percent of global nitrogen oxide (NOx) emissions. Combined with other air pollutants, such as particulate matter (PM), these emissions caused shipping to be responsible for an estimated 15 percent of global premature deaths from air pollution— or 60,000 in absolute numbers— in 2015.

LNG – an all-purpose answer to shipping’s atmospheric pollution issue?

In an effort to curb air pollution from shipping, some shipowners have turned to liquefied natural gas (LNG) as the bunker fuel of choice since it emits significantly fewer air pollutants and contains 30 percent less carbon than HFO. However, LNG’s potential to help shipping reach its GHG reduction goals is questionable. While LNG’s may be less emissive than HFO, it is still categorically a fossil fuel and will fail to fully decarbonize the shipping sector. Evidence also suggests that LNG’s theoretical GHG benefits might not materialize in practice. LNG has an inherent risk of methane leakage as a bunker fuel, whereby methane unintentionally escapes into the atmosphere during its production, transportation, and use. Estimated to be 86 times more potent than CO2 over a 20-year-period (and 36 times over 100 years), methane has grave climate change implications as a GHG, especially on a near-term basis. Moreover, many LNG-fueled ships in operation today are equipped with the leakiest type of engine, according to the International Council on Clean Transportation (2020), hence exacerbating the issue of methane leakage.

"Estimated to be 86 times more potent than CO2 over a 20-year-period (and 36 times over 100 years), methane has grave climate change implications as a GHG, especially on a near-term basis."

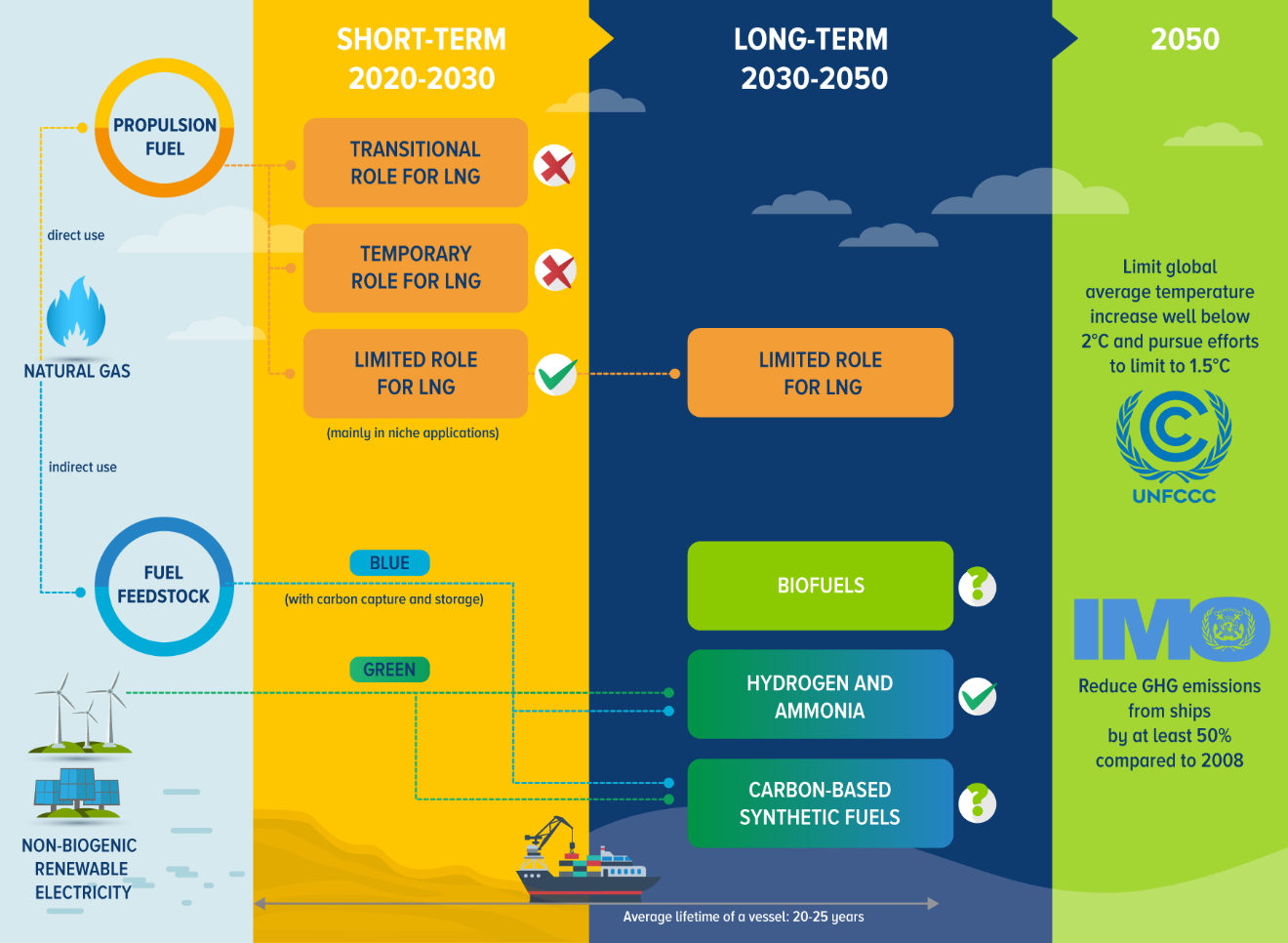

A sector-wide approach from a short- and long-term perspective

In collaboration with the University Maritime Advisory Services, the World Bank evaluated the potential role of LNG in shipping’s energy transition in a new report, “The Role of LNG in the Transition Toward Low- and Zero-Carbon Shipping.” The report uses a sector-wide and technologically agnostic approach to evaluate the short- and long-term impact of GHG emissions across a 20- and 100-year timeframe. The report also considers the secondary impact of how methane emissions can reduce the amount of important atmospheric gases, such as ozone (O3) and hydroxyl (OH), and in turn inhibit the removal of GHGs from the atmosphere. Finally, the report acknowledges that emissions during LNG extraction are difficult to estimate and may be higher than generally assumed, depending on the extraction method.

"In collaboration with the University Maritime Advisory Services, the World Bank evaluated the potential role of LNG in shipping’s energy transition in a new report, “The Role of LNG in the Transition Toward Low- and Zero-Carbon Shipping.”"

The report investigates three possible roles for LNG to be used in transitioning the industry:

- A transitional role (“use and reuse”): LNG infrastructure and vessels built today could later be reused from 2030 onward with compatible zero-carbon bunker fuels.

- A temporary role (“use and stop”): LNG could be used as much as possible until 2030 before it is supplanted by emerging zero-carbon bunker fuels.

- Limited role (“limit the use overall”): LNG could be utilized as a bunker fuel for only limited, niche applications.

After examining these three scenarios, the analysis finds that LNG as a bunker fuel will most likely only play a limited role. The implication is that LNG will be primarily utilized on specific routes with existing LNG terminals or on selected vessels, such as ferries or cruise ships, where air quality is a greater concern than GHG emissions.

In contrast, the report demonstrates that LNG is unlikely to play either a transitional or temporary role in the decarbonization of the shipping industry. Biomethane and synthetic methane are the only zero-emission bunker fuels able to reuse existing LNG infrastructure, which would allow LNG to have a transitional role. However, the availability of large amounts of sustainable and affordable biomass required to produce biomethane appears very uncertain. Additionally, synthetic carbon-based fuels like synthetic methane are expected to be more expensive than alternatives like ammonia or hydrogen. Another World Bank report, “The Potential of Zero-Carbon Bunker Fuels in Developing Countries,” examines all these fuel candidates and their potential to decarbonize the shipping industry.

Even in a temporary role, the use of LNG in maritime transport would only reduce GHG emissions by a modest amount at best. At worst, the temporary use of LNG could result in a peak GHG disbenefit of 9 percent by 2030. The report estimates that temporary LNG use would be associated with 10 to 17 percent higher capital expenditure than a direct shift to zero-carbon bunker fuels. A large number of LNG vessels and infrastructure would be at risk of becoming stranded assets and potentially exacerbate the lock-in of fossil-fuel technology in the industry.

Despite the findings, the analysis also suggests that natural gas, in its non-liquefied state, could still play an essential role in the transition toward zero-carbon shipping as fuel feedstock for “blue” zero-carbon bunker fuels. “Blue fuels” are derived when natural gas is combined with carbon capture and storage technology, producing ammonia and hydrogen. Ammonia and hydrogen can also be generated from renewable energy, in which they are dubbed “green fuels.” Consequently, natural gas could help kickstart the production of “blue” zero-carbon bunker fuels before enough renewable electricity allows for a shift towards their “green” counterparts.

Impacts and outlook

Large-scale use of LNG risks delaying shipping’s inevitable transition to zero-carbon bunker fuels and impedes the overall reduction of maritime emissions. Fossil-free alternatives must be adopted as quickly as possible to place the industry on a GHG emissions trajectory that is consistent with the IMO’s climate target and the Paris Agreement’s temperature goals.

To ensure that this transition is fast, efficient, and financially robust, comprehensive lifecycle GHG assessments should be applied to any bunker fuels being considered as a low-or zero-carbon alternative to HFO. Policymakers will also need to provide regulatory consistency and clarity to market operators to help facilitate and support new research and investments in zero-carbon bunker fuels. Furthermore, these findings imply that new and existing public policy supporting LNG as a bunker fuel should be reconsidered, and methane emissions be regulated more closely. Subsequently, industry stakeholders should account for the wide range of financial and regulatory risks when considering new investments in LNG vessels or infrastructure.

RELATED

Zero-carbon shipping: A sea of opportunities for developing countries

Join the Conversation