The paper shows that reaction shocks are associated with a significant decline in EMDE investment and private consumption. Photo: John Hogg / World Bank

The paper shows that reaction shocks are associated with a significant decline in EMDE investment and private consumption. Photo: John Hogg / World Bank

The sharp rise in U.S. interest rates over the past year poses a significant threat to emerging market and developing economies (EMDEs). In a recent paper, we show that the impact of U.S. monetary tightening on financial conditions and economic outcomes in EMDEs is likely to be all the more severe, given the factors that have been driving the tightening cycle.

We identify three potential drivers of rising U.S. interest rates: (1) “real shocks,” which are prompted by improved prospects for U.S. economic activity; (2) “inflation shocks,” which reflect expectations of rising U.S. inflation; and (3) “reaction shocks,” which reflect investors’ assessments that the Federal Reserve’s reaction function has become more hawkish. We show that, over the past year, rising U.S. interest rates have been driven mainly by reaction shocks, as the Fed has pivoted toward more aggressive action to rein in inflation (figure 1).

Figure 1: Drivers of 2-year U.S. interest rate yields in 2022

Note: Shocks are estimated from a sign-restricted Bayesian vector autoregression (VAR) model with stochastic volatility. Figure shows cumulative change in underlying shocks and yields since January 2022. Inflation shocks are prompted by rising expectations of U.S. inflation. Reaction shocks are prompted by investors’ assessments that the Federal Reserve has shifted toward a more hawkish stance. Real shocks are prompted by anticipation of improving U.S. economic activity.

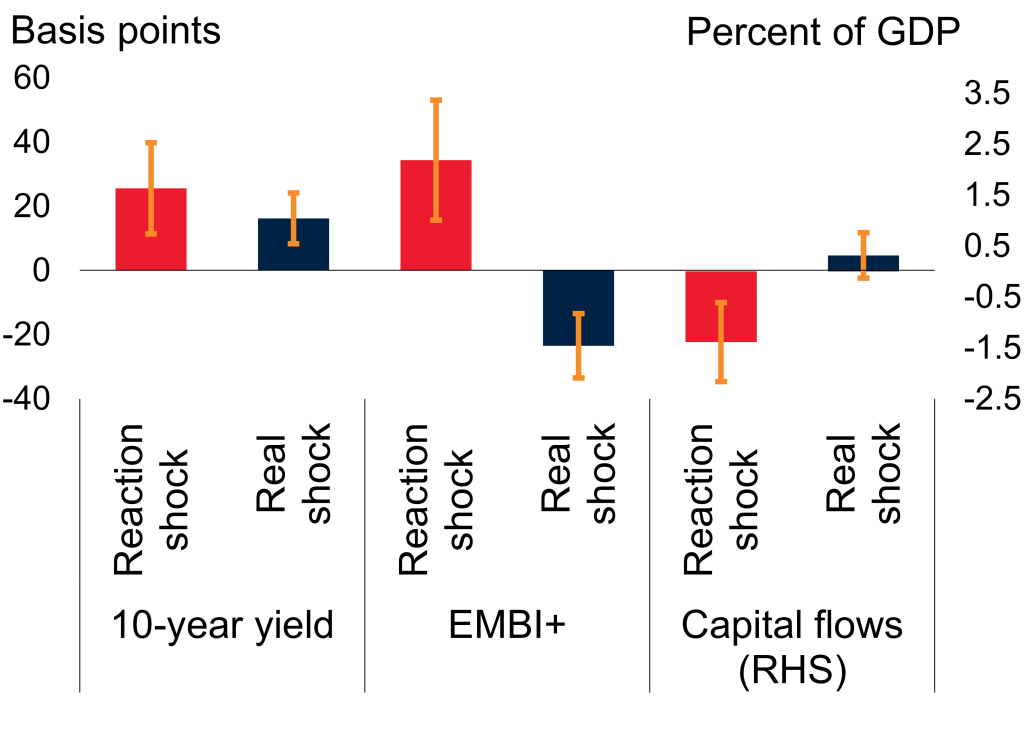

We then use these shocks to assess how they affect EMDEs. We find that increases in U.S. interest rates driven by reaction shocks are especially detrimental to financial markets in EMDEs, in part because they depress investor sentiment. In particular, reaction shocks boost 10-year EMDE local-currency bond yields, widen EMBI+ sovereign risk spreads, and dampen capital flows (figure 2). They also depreciate currencies and depress equity prices. In contrast, real shocks to U.S. interest rates tend to be followed by more benign movements in EMDE financial markets, likely because such shocks are associated with positive prospects for U.S. activity and imports.

Figure 2: Impact of U.S. interest rate shocks on EMDE financial markets

Note: Figure shows impulse responses after one quarter from panel local projection models with fixed effects and robust standard errors, to reaction-function shocks and real shocks. Positive “capital flow” values reflect an increase in net liabilities of portfolio and other investments for EMDEs. Orange whiskers reflect 90 percent confidence intervals. EMBI+ spread is a proxy for sovereign risk.

The differences in the types of U.S. interest rate shocks extend to their effects on economic activity in EMDEs. Reaction shocks are associated with a significant decline in EMDE investment and private consumption. In contrast, real shocks lead to higher real exports.

Figure 3: Impact of U.S. interest rate shocks on EMDE economic activity

Note: Figure shows impulse responses after one quarter from panel local projection models with fixed effects and robust standard errors to real shocks and reaction shocks. Orange whiskers reflect 90 percent confidence intervals. “Output” is real gross domestic product, “Consumption” is real private consumption expenditures, and “Investment” is real gross fixed capital formation.

Join the Conversation