Woman and man look over computer screen together

Woman and man look over computer screen together

What do we know about civil society engagement in tax administration? Given the importance of equitable domestic resource mobilization to the “Building Back Better” recovery efforts, and based on research and investment in accountable tax systems, the Transparency and Accountability Initiative invited IDinsight to synthesize recent evidence and share the findings at a World Bank co-hosted discussion. Here's a rundown of what the evidence tells us and a potential way forward.

The Addis Tax Initiative's 2025 Declaration emphasises the role of accountability stakeholders

As countries begin to recover from the 2020 recession and increasing levels of debt from the COVID-19 pandemic, they will need to increase the revenue raised domestically to finance immediate recovery efforts as well as longer term national development priorities. The 2025 Addis Tax Initiative (ATI) Declaration highlights the importance of efficient, effective, and transparent revenue administration, and commits to enhance "the space and capacity for accountability stakeholders in partner countries to engage in tax and revenue matters."

So, what do we know about the role of civil society in tax administration?

The Transparency and Accountability Initiative (TAI) commissioned IDinsight, an international development research, Monitoring & Evaluation, and data analytics not-for-profit, to synthesize recent evidence of civil society groups contributing towards more equitable and efficient tax administration. The findings from the report and the policy brief were discussed at an event co-hosted by the World Bank, TAI and members, IDinsight, the Bill & Melinda Gates Foundation, and USAID.

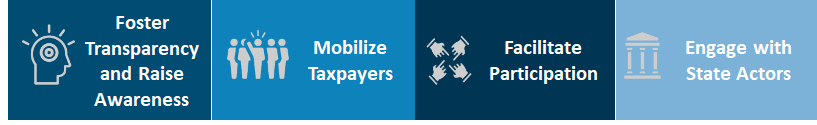

CSOs can play four distinct roles in the tax administration ecosystem

CSOs engage with a wide spectrum of stakeholders including revenue authorities, parliament, judicial system, taxpayers, media, and academia. In this context, they can play four distinct roles in this system:

- Fostering transparency and awareness by conducting independent research and/or illustrating the link between compliance and public services provision.

- Mobilizing taxpayers through coalitions with other non-state actors on sub-national, national, or even international levels to improve the tax administration.

- Facilitating participation in tax bargaining and supporting demands for transparency and accountability.

- Engaging with state actors to enhance responsiveness to taxpayer concerns using collaborative and confrontational approaches.

There is not much evidence on the CSOs effectiveness in the four roles. First, while about half of the CSOs that work on tax topics report engaging in awareness and literacy activities, there is only little evidence documenting CSOs' efforts around administrative topics such as tax compliance and the link to public service provision. Second, there are few examples of CSOs successfully mobilizing taxpayers by working through partners such as Oxfam's support in establishing the Tax Justice Alliance. Third, in some cases CSOs appear to have created safe and inclusive spaces for citizen-state interaction, for example through leveraging grassroot links or digital tools. Finally, while there is anecdotal evidence of CSOs collaborating with revenue authorities on awareness raising and compliance, they don’t necessarily contribute to more equitable tax systems .

Reflections from funders, practitioners, and researchers that could shape a potential way forward:

- Understanding the system and power dynamics is key. How inclined are CSOs to engage on domestic topics of taxation and tax administration? What (technical and soft) skills they ought to have for such engagements to bear fruit?

- Constructive engagement between civic and state actors to increase trust in the fairness, equity, reciprocity, and accountability of tax systems in line with the World Bank's initiative on Innovations in Tax Compliance. Where do policymakers' incentives to advance equitable tax systems align with mandates from revenue authorities? Can civil society actors help create political cover for tax authorities to enforce rules without interference, e.g. for high-net-worth-individuals?

- Tax programming needs to be both technically and politically smart. How can funders provide the long-term and flexible support that CSOs need to react to opportunities as they arise and to coordinate efforts across coalitions?

- Ample opportunities exist to expand the research and knowledge base on CSOs work in tax administration. How can research be co-created in early stages of engagements to allow for deeper and more rigorous learning? What accountability criteria can we define to characterize tax systems on a more granular level?

Avenues to further our understanding of CSOs role in fostering equity in tax administration

We offer three promising avenues for funders that emerge from this initial conversation:

- Support more collaborative engagement between non-state actors and tax administrators to advance trust and equity in tax systems.

- Further strengthen civil society's ability to assess administrative performance to identify potential areas for reform and hold authorities accountable for equitable enforcement.

- Positioning CSOs/coalitions as allies in advocating for sufficient budgets/resources allocated to revenue authorities. e.g. for taxpayer education, implementing equity enhancing policies, pursuing audits (recognizing, of course, that budget alone is no guarantee of effectiveness).

Are you a funder, practitioner, or researcher who wants to be part of the conversation around shaping civil society's engagement in tax administration? Share your ideas below! You can also reach out to Steve Davenport sdavenport@worldbank.org, Anna Custers, acusters@worldbank.org, or Michael Jarvis, mjarvis@transparency-initiative.org

Join the Conversation