Many countries have started to apply taxes on sugar sweetened beverages and products high in sugar to promote healthy diets and compensate for the health care costs associated with high sugar diets. Copyright: Adobe Stock

Many countries have started to apply taxes on sugar sweetened beverages and products high in sugar to promote healthy diets and compensate for the health care costs associated with high sugar diets. Copyright: Adobe Stock

The sugar industry has played an important historical role in building economies around the world, spurring job creation and investment in non-sugar sectors. The economic multiplier effect of sugar mills has been well documented. In Mauritius for example, the total economic multiplier of sugar milling has been estimated to be 2.6, higher than the textile and financial intermediation sectors. But governments are now recognizing the high cost of added sugars on human health and are taking action to reduce sugar consumption.

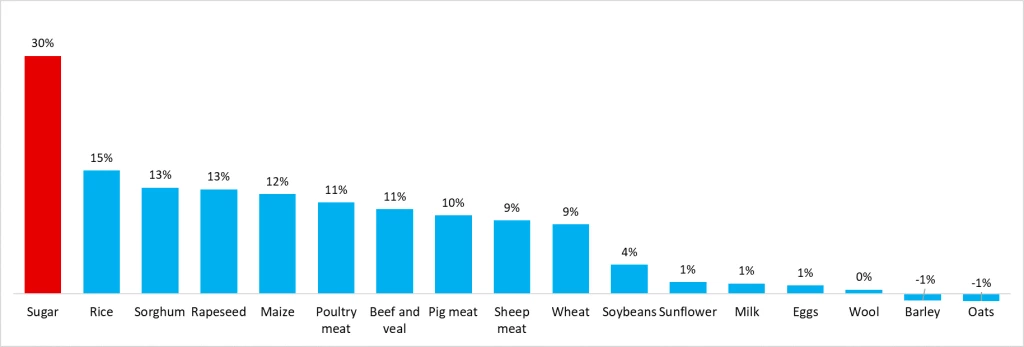

Today, 20 different types of sugars are produced to be added to food or drinks (called “added” or “free sugars”). Government support to sugarcane and sugar beet farmers is the highest among all agrifood commodities, as measured by the producer support estimate as a share of gross farm receipts. In 2018, sugar farmers received nearly 30 percent of farm receipts from support (see Figure 1). Most of this support comes in the form of market price support, which keeps domestic sugar prices high, thereby disincentivizing consumption but also incentivizing domestic production.

Figure 1: Producer support estimate as a share of total gross farm receipts across commodities in 2018

Note: Data from OECD stats “Producer and consumer support estimates,” Agrimonitor, and author’s calculations.

Addressing the social costs of sugar

What are the social costs to supporting production of free sugars, particularly when it comes to health? Food marketing, the growth of supermarkets, urbanization, and increases in income are all linked with increased free sugar consumption. These changes in diets and lifestyles are tied to increased prevalence of noncommunicable diseases (NCD) like diabetes, cardiovascular diseases, certain types of cancers, and overweight and obesity. One in five deaths globally are due to unhealthy diets and the number of people who are overweight or obese has surpassed 2 billion, with the greatest health burden falling on the poor. In part based on this risk, the World Health Organization (WHO) recommends reducing the intake of free sugars to less than 10 percent of total energy intake.

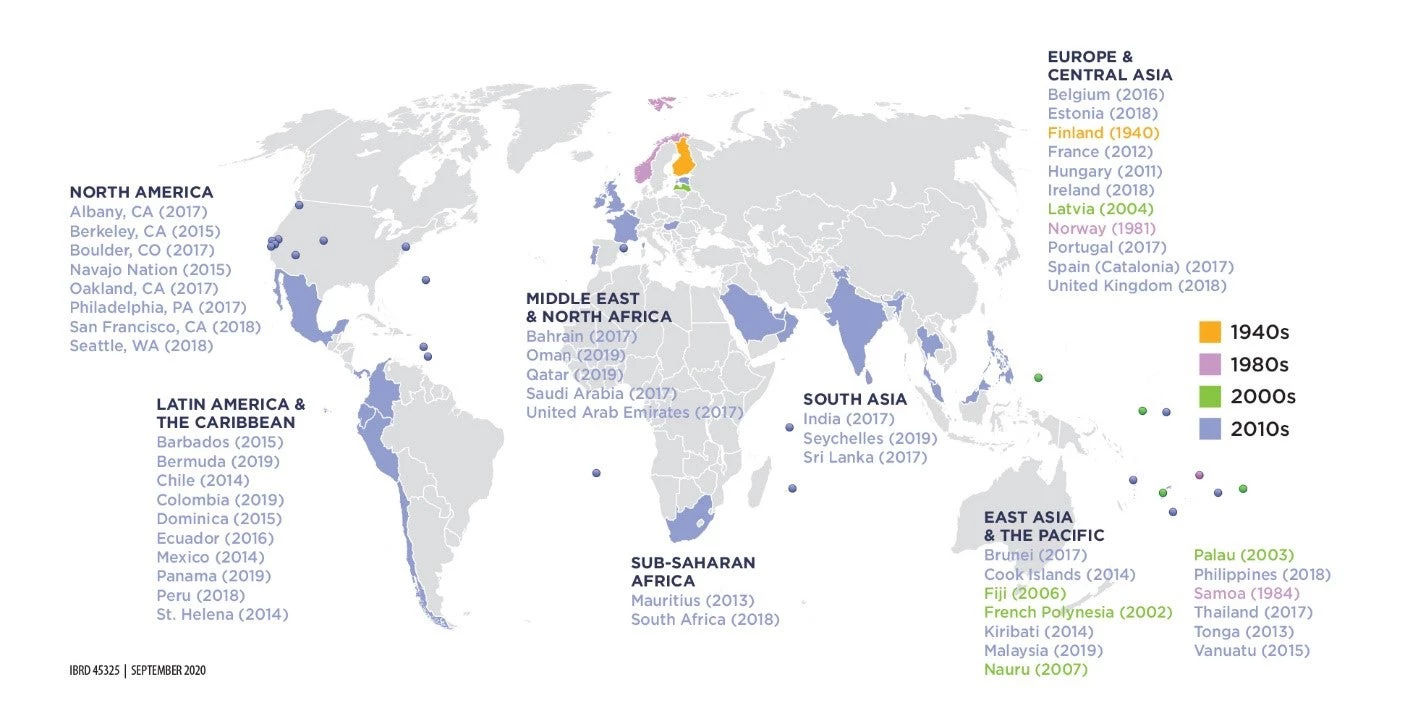

Figure 2: Taxation of sugar sweetened beverages (SSBs) around the world

Note: Taxes on Sugar-Sweetened Beverages: International Evidence and Experiences, September 2020.

Rather than incentivizing domestic sugar production, public policy may be better-off shifting, for example, towards taxation on sugar consumption. These tax revenues may then be used to compensate for the cost of health care given the impact of free sugar consumption on NCDs. The WHO recommends a comprehensive suite of population health approaches to promote healthier diets, including regulations, taxes, and education. Many countries have started to apply taxes on sugar sweetened beverages (SSBs) and other products high in sugar, as they do for tobacco and alcohol (see Figure 2).

Evidence is emerging on the positive health and economic impacts of such policies. Mexico’s 10 percent SSB tax (see here and here) led to a decline in consumption of SSBs by 7.2 percent in the first two years, as well as a projected decrease in NCD burden and savings of up to US$1 billion over a 10-year period. And contrary to popular belief, taxes on SSBs are progressive since they disproportionately benefit the poor (see here). The World Bank has developed an assessment of the experience on SSB taxes, and will support countries on health tax reforms.

Governments are still supporting the production of free sugars for a variety of reasons. For example, the sector employs low-income workers and farmers; abandoning sugarcane and sugar beet plantations may have detrimental environmental effects; and sugar production is important for local economic development and for balance of payments. There is a clear need for analysis that considers viable alternatives to free sugar production and their impacts on employment and socio-environmental aspects. But shifting away from market price support of sugar production to taxation of sugar consumption can help disincentivize consumption, while increasing fiscal revenues to address the health costs of sugar consumption.

Aligning policies for better health

Moving towards the realignment of health and agriculture public policies towards better health outcomes may be a win-win solution. And there are opportunities to align agricultural policies which promote production of sugar with health policies which curb free sugar consumption. Under the Food Systems 2030 program, the World Bank supports countries to identify opportunities to repurpose agriculture policies and financial support and to make healthy nutritious diets more affordable.

Given the global food crisis and fiscal constraints, this realignment of agriculture incentives is even more relevant. There are lessons to be drawn from transition programs implemented for tobacco farmers for example, to support the transition from sugarcane and sugar beet to other agriculture and rural activities; and alternative uses can also be developed, especially in the energy sector. This is politically doable if the international community works together to chart a transition plan for farmers and industry workers. The time for action is now.

Shobha Shetty, Barry Popkin, Hina Sherwani, and Alex Vaval Pierre Charles contributed to this blog.

Join the Conversation