Over the past decade, bus rapid transit (BRT) has been regarded as an effective solution to the challenges faced in many cities in Sub-Saharan Africa (SSA) as a mass transit system with the potential to be delivered more rapidly and at relatively lower cost. However, despite the increasing interest from African governments in engaging the private sector, the mobilization of private sector capital has been slow and difficult.

What are the key considerations behind the hesitancy shown by the private sector and how can they be motivated to invest in bus rapid transit in Sub-Saharan Africa? Our recent study “Enhancing Financial Sustainability and Commercial Viability of BRTs in Sub-Saharan Africa-Market Analysis” investigates the private sector’s feedback.

How did we go about this? We looked at the investment appetite and risk tolerance based on consultations with public and private sector groups, international financial institutions (IFIs), public investment funds, private investment funds, development finance institutions (DFIs), commercial banks, operators, and bus manufacturers. It’s notable that most investors expressed their interest in BRT projects in SSA regardless of having experience there or not (Figure 1), although investors perceived the SSA market riskier than in other geographic areas.

They perceive the main risks as complex geometry and mobility patterns, weak institutional capacity, demand and subsidy risk, insufficient capacity of project design, inappropriate fare level and adjustment, automatic incumbent operators, and volatile currency. In particular, investors voted the risks related to incumbent operator management, expropriation, and government subsidy as the top one risk respectively for BRT development, construction, and operation (Figure 2).

Nevertheless, investors confirmed interest in two main PPP schemes including:

1. The “operation-centered” structure where the private partner takes responsibility for the provision as well as operations and maintenance of the fleet, intelligent transport systems (ITS), and fare collection systems. This leaves the public authority in charge of infrastructure delivery and maintenance.

2. The “fully integrated” PPP scheme where the private partner is responsible for the infrastructure design, construction, and maintenance, as well as the provision of all operational services and associated equipment.

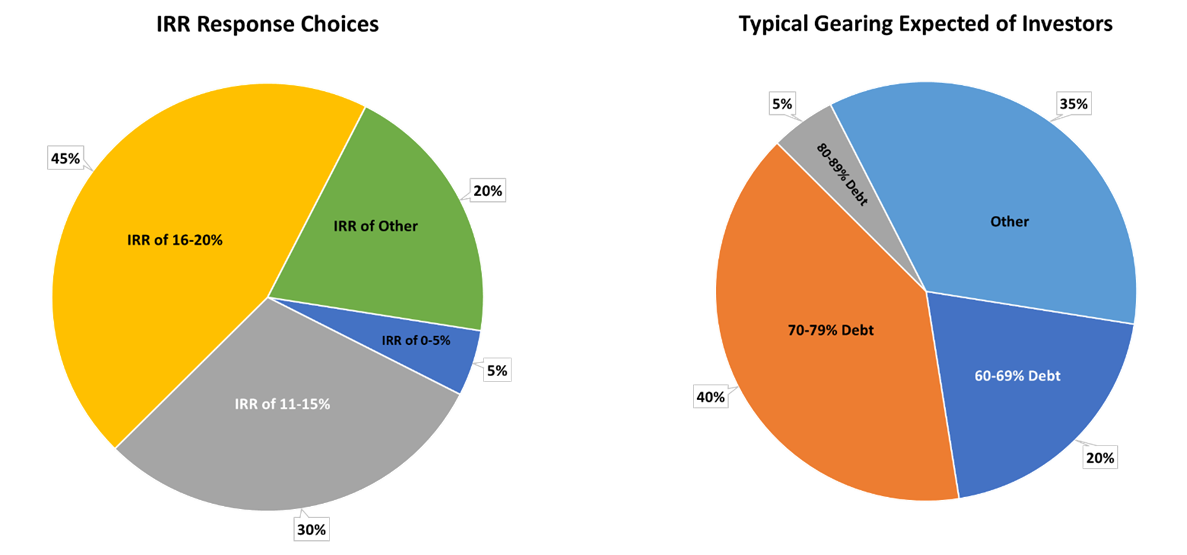

The features of these two schemes reflect a larger appetite of investors for the SSA BRT projects with small to medium capital value, relatively high equity internal rate of return, high debt/equity ratio, significant engagement of public authority, and risk mitigation measures in place (Figure 3).

So, what could be the optimal financing schemes from the perspective of the private sector? Investors reached broad consensus on three aspects. First, public funds (from cities or central government) are needed for project development and infrastructure delivery. Second, private financing can be raised for the bus fleet and operations equipment through a hybrid of equity, debt, and insurance/guarantee products. Third, the involvement of IFIs/DFIs remains essential both for the provision of financing (concessional sovereign lending and project debt) and credit enhancement products (payment guarantee and political risk insurance).

Here are key recommendations to make Sub-Saharan Africa bus rapid transit projects more attractive to private sector investment:

- Dedicate the time and effort needed in upstream planning activities

- Design BRT to respond to the local needs and ensure alignment with costs considerations and ability to pay

- Set up a clear and transparent fare adjustment mechanism

- Undertake PPP option analysis and structure a PPP scheme that will attract experienced and credible investors

- Explore the full range of financing options and innovative financing mechanisms

- Ensure the sustainability of required fiscal support and diversify the revenue sources for investors

- Maintain the public sector’s support in the operations and maintenance phase

- Engage IFIs/DFIs to de-risk BRT projects

The role of the IFIs/DFIs in encouraging the participation of the private sector is very crucial. We recommend the IFIs/DFIs assist the public sector with capacity building on a variety of topics throughout the BRT project life cycle, provide technical assistance to the public sector by systematically assessing the project and identifying financially sustainable solutions, provide financing and credit enhancement products such as concessional lending, insurance against political risks, and underwriting of first loss insurance to the local currency, as well as explore innovative financing approaches such as fleet acquisition through a bus leasing model with IFI co-financing and mobilization of climate financing sources to SSA BRTs.

Clearly, there’s a need to fill with respect to better connectivity in SSA that gets people to job and educational opportunities—not to mention goods to market—more efficiently and cleanly. At the same time, our research has shown strong interest from the private sector, with public sector support, to take this subsector on. Let’s redouble our efforts to put the pieces in place to make the BRT subsector in SSA a viable option for people across the subcontinent.

This work was made possible by the support of the Public-Private Infrastructure Advisory Facility (PPIAF), the Africa Transport Policy Program (SSATP), and the Mobility and Logistics Multi-Donor Trust Fund (MOLO).

Related Posts

Improving the viability of Bus Rapid Transit systems: Nine factors for Sub-Saharan Africa

How to attract private finance to Africa’s development

Three criteria to better classify PPPs in Africa

Lagos’ Bus Rapid Transit System: Decongesting and Depolluting Mega-Cities

Five secrets of success of Sub-Saharan Africa’s first road PPP

This blog is managed by the Infrastructure Finance, PPPs & Guarantees Group of the World Bank. Learn more about our work here.

Join the Conversation